Hello everyone. I will show the ETF portfolio that I want to build over time. In my eyes, the purpose of an ETF portfolio is that it needs to be simple. This is also its main strength. You don’t have to spend hours and hours researching different companies and you’ll probably beat most of the investors that do! If you are not really sure about what an ETF is exactly you can check out this post!

Three ETFs

Three funds. Three exchange-traded funds, that is all you need to be perfectly balanced. This way you’ll be perfectly diversified and be able to sleep at night. Keep in mind that I am still young (and aggressive) and that I’m not investing in bonds quite yet. I also have some exposure to P2P Lending which is basically like bonds if you think about it. Alright, here we go.

IWDA (IE00B4L5Y983)

The first one I would recommend is IWDA (IE00B4L5Y983). This fund should, in my opinion, be the biggest part of your portfolio. This is an accumulating ETF (if you want to know the difference between accumulating and distributing ETFs, check out this post!). The choice between an accumulating or distributing ETF depends primarily on the tax situation in your country. I’m from Belgium and over here we have a 30% tax on dividends which we don’t have to pay when the ETF reinvests them for us. On the other hand, I don’t have to pay capital gains tax when I sell. Fingers crossed this will still be the case when it is my time! This ETF mainly covers large caps in the developed world.

EMIM (IE00BKM4GZ66) / IEMA (IE00B4L5YC18)

The next fund I plan on buying is EMIM (IE00BKM4GZ66). Again an accumulating ETF for the reasons explained above. This one mainly covers large caps of emerging markets but mid-caps and small caps are also included. This way I’ll have exposure to the markets in Asia, Latin America, Africa, …

EMIM was also recently added to the Degiro free ETF list!

If you are not interested in small caps, which is totally fine, you can also choose to pick IEMA (IE00B4L5YC18). This is also an accumulating ETF that covers emerging markets but only large and mid-caps. The fund size is a bit smaller than EMIM (but still quite sizable). For this reason, it could be less liquid but probably not to an extent that it is a problem for normal investors. The upside is that this one is also free on Degiro to purchase!

IUSN (IE00BF4RFH31)

The last fund I am probably going to buy is IUSN (IE00BF4RFH31). Once again, accumulating is the way to go for me. The one covers small-cap stocks all over the world. This way I’m not only invested in large caps, yet another way to diversify!

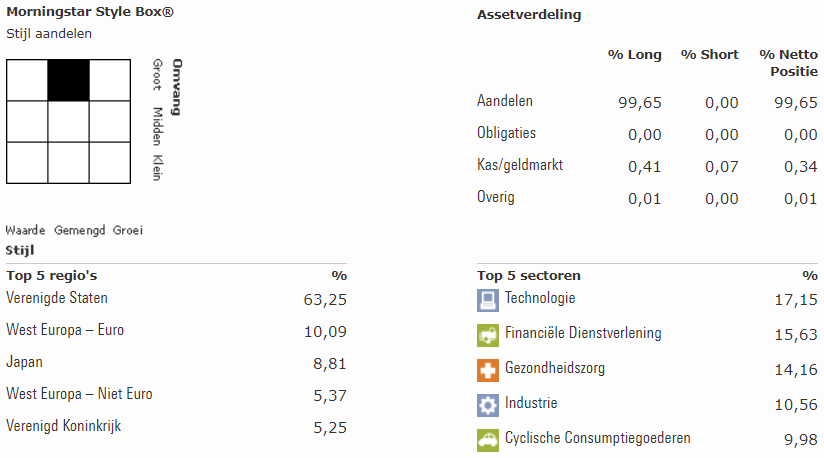

Best ETF portfolio overview

This is the portfolio allocation I want to go for. The total TER should be 0,2035% which is a very decent number.

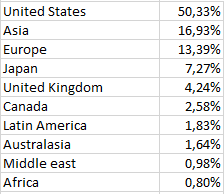

This is the weighted region percentage of the three ETF’s I want in my portfolio. As you can see there is a lot of diversification across different regions and this is what I’m looking for.

Do you have any questions or do you think I’m missing something? Let me know in the comments below or send me an email. I would love to hear your feedback!

Good advice here. Thank you

Hey François, Thank you for leaving the first comment on my blog and thank you for the appreciation as well. I hope to grow this blog in to a small community in the future so I really appreciate you taking the time to do this!

Cool portfolio! Nicely balanced and cost-efficient. I was thinking also VWRP instead of IWDA + EMIM as an option.

Hello boolq, VWRP is an option for sure instead of IWDA+EMIM. It had a slightly higher TER though + I want the choice of adding slightly more emerging markets to my portfolio. I also don’t think it is on the free ETF list of Degiro!

Good choice! Thanks for sharing and good luck on your financial journey.

Thanks, you too!!

Only the first one you talk about (IE00B4L5Y983 | ISHARES MSCI WOR A) is on the free ETF list of Degiro, is that right?

I haven’t found the EMIM or the IUSN on there (https://www.degiro.co.uk/data/pdf/uk/commission-free-etfs-list.pdf). Thanks!

Hello, Grillo,

I think you are correct. Even though they aren’t on the free list of Degiro I do think they are the best options. You aso have to buy them mess frequently because of smaller portfolio allocations sonyou still won’t pay a lot of fees!

What is your reason to choose iShare Core World before S&P 500 as main ETF?

A S&P 500 ETF would only give me exposure to the US Market. If I buy a World ETF I get exposure to other developed markets as well. This world ETF still is 60% US markets since the US Market is the biggest in the world at the moment. But there is no guarantee that the US will still be the best place to put my money in the future. This is why I rather diversify more. I hope this answers your question!

Hey, nice post and good research! Im looking into building a similar portfolio.

What do you think about IE00BFY0GT14 (msci world from spdr) instead of IWDA?

It isnt on free list for Degiro but has TER of 0.12%, quite a bit lower. It beats IWDA on total costs after some years, even with monthly investing.

Just some theory 🙂 amazing blog, i will follow! Thanks for your opinion

Hello arctiic,

I’ve seen you commented 2 times, probably because I first have to approve your comment before you can see it! (I’ll delete the other one since the question is the same!)

SPDR msci world IE00BFY0GT14 is definitely a good choice as well. I’ve came across it while doing my research. There are two things that made me choose IWDA instead of the one that you are proposing. The first is that IWDA is on the Degiro free list, I’d have to do the math but in the (very) long run SPDR msci world would probably come out on top although I don’t think you will really see the difference. The second thing which was more important to me is that IE00BFY0GT14 is a very new fund. It started 28 February 2019. Because it is still very new it is a lot smaller as well. €313mil vs €21179mil for IWDA. Since smaller funds have a bigger chance of shutting down I decided to go with IWDA.

That being said SPDR msci world IE00BFY0GT14 looks like a very good fund with a very good TER. It will probably grow in size in the future so if you prefer it, go for it! 🙂

Haha yeah sorry that was exactly the case with the 2nd comment :D.

Ok yeah that makes sense its really close also in the long run youre right. SPDR a little little bit on top. I see, the smaller fund size is a bit of a risk as you say yeah. Ive seen it recommended on other blogs too though, so i think i will have faith. Thanks for your quick answer!

You will for sure do fine with it. Just stick to your strategy and you’ll get there in the end! Good luck to you!

You can take into account tracking differences too. IE00B4L5Y983 tracking difference is very small only 0.1 https://www.trackingdifferences.com/ETF/ISIN/IE00B4L5Y983 For IE00BFY0GT14 we don’t know, because it is too young. However, SPDR has better TDs than iShares in general but it has 3x more funds. Based on this https://www.reddit.com/r/ETFs_Europe/comments/fue07l/european_etfs_providers_costs_the_best_and_the/ I assume IE00BFY0GT14 will have a bit better TD than IE00B4L5Y983, the question is if will impact your investments or not.

Hello Andrej,

I don’t think it will impact my investments in the near future. IE00BFY0GT14 is indeed still very new and the fund size is still quite small as well. Those are two things that I don’t really like. If better funds would become available I would definitely think about switching but right now the differences are just too small for me to think about.

Good question!

Michiel

Hey I have a question. So IWDA automatically reinvests the dividends? All you do is buy it on Degiro and then it’s automatically reinvested? Is there any way to find out how much dividend they are actually reinvesting or not?

Hello Wilco,

Thanks for the comment. IWDA indeed automatically reinvests the dividends. This does not mean that you will get more shares over time. What happens is that the ETF manager receives the dividends and invests them for you. This will cause the fund to grow bigger which will make each share worth more.

You can know the dividend yield by taking a look at a fund with the same index which distributes its dividends. This one for example. The share price at the moment of writing is around €45.68. Last years dividends per share were €0.72. If you do the math you can see that the yield is around 1.6%. For IWDA this will be the same.

If you compare the return of this fund (if you don’t include dividends) vs IWDA. You can clearly see the difference. IWDA returned over 68% the last 5 years. While the distributing fund return a little over 52% the last 5 years. If you include the payed out dividend you get about the same. Which is normal. 🙂

I hope this answered your question? 🙂

Yes thank you so much!

Hi, I have a really similar portfolio as a fellow Belgian . Still looking for my small cap exposure, and came across IUSN (IE00BF4RFH31) ass well. Don’t know if you have any other recommendations for me to consider?

Hello Adriaan,

In my search for small cap world ETF’s I found this to be the best choice. Of course maybe you don’t want to diversify with small caps but rather with mid caps, or maybe you want a bit more exposures to real estate with REIT ETF’s this is up to you off course. 🙂

You can always screen for ETF’s by filtering what you want on this website.

I hope this still helped you a little bit?

Good luck on your investing journey!

Hello. Why would you choose to diversify with small caps rather than mid caps? Also, could you advise me a world mid cap ETF? Something like IWDA but with mid caps. I came across only to IWSZ (IE00BP3QZD73).

Thank you

Hello Lolo,

IWDA already has a certain percentages of what could be considered mid cap companies and IUSN also has a percentage of mid cap companies. This is why I chose to pick a small cap ETF.

If you really want a mid cap fund, IWSZ certainly seems fine at first glance! 🙂

I was looking for IWDA on degiro to buy as my first investment. But it showed me two options. One is: ISHARES MSCI WOR A and the other is ISHRC MSCI WLD. Now I been trying to look everywhere on the internet and I can’t seem to find the answer on which one to get.. They have the exaxt same ISIN too. Is really the only difference that one is in EUR and one in USD? I assume since I live in a EUR country I best buy the MSCI WOR A?

Hello ‘IWDA’,

These are the same ETF’s only on different exchanges. ISHARES MSCI WOR A is on the Euronext Amsterdam exchange (which you can buy for free) and ISHRC MSCI WLD should be on the London Stock Exchange.

If you don’t want to pay the fees buy ISHARES MSCI WOR A!

Hi mate,

First oficial all really appreciate you sharing tour journey, I started investing recently and its good to see how others are doing.

I have a couple of questions for you:

1.Do you see (vanguard S&P 500) IE00B3XXRP09 and (MSCI world) IE00B4L5Y983 too similar positions?

2. Do you see P2P lending as short term investing? (1-3 years) which platforms would you recommend to start with?

Many thanks,

Emilio

Hello Emilio,

1. To start with, IE00B3XXRP09 and IE00B3XXRP09 cover 2 different indexes. the first only covers companies that are in the S&P 500 (The biggest companies in the US Market) The second one covers the whole developed world. Both are fine ETF’s though but they serve different strategies. I prefer to invest in the whole world. It is true that the US economy was the best performing over the last years but past performance does not guarantee future results and for that reason I like to be as diversified as possible. If you want to invest specifically in the US stock market, Go for it! Depending on your strategy you want to go for different allocations as well.

2. I don’t have a lot of experience investing in P2P lending yet. The little experience that I do have is certainly positive though. The one that I’m using at the moment is Mintos. If you pick the best loan originators I think you can mitigate the risks a lot. Off course it is a very new market and time will show whether the risks are higher than they seem. If you want my take on the best lending companies you can check out this post. If you want the best (compounding) results long term will still be the best although with P2P investing I do think you can do it for a short term as well if you want!

Hi Michiel,

Thanks for your fast reply! Will have a look at mintos.

I notice that the 2 etfs: EMIM and IUSN are not in the commission free ETF list from Degiro, arent There free alternatives?

Best,

Emilio

Hello Emilio,

I found these to be the best ETF’s for there purpose. I know there are not free but In my case I buy them maybe once a year so I will not pay to much fees anyway.

Thanks for the information! how would you balance the 3 etfs?

Hi thebraindamag3,

Do you mean the percentages I’m going to use? Those you can see in the blog post itself. 🙂

If you mean how I’m going to re-balance when needed: My plan right now is to just buy the ETF I need the most each month to be as close to the allocation percentages as possible!

Thanks for the clarification Michiel! I’m planning to invest from a HK broker but I just have access to US etfs. I found URTH. I was wondering if it is the same, I can’t spot any difference with IWDA.

Thanks!

Hello THEBRAINDAMAG3,

For some reason I missed this reply. I’m sorry. I have to say that I don’t have a lot of knowledge about US etfs. I took a quick look at it and it seems a lot like IWDA. I don’t think US etfs have the concept of accumulating dividends though. Some important factors to look at when investing in a certain ETF are: How big is the fund size? What does it cover? Does it pay dividends? What is the TER? …

If you have answers to all these questions and you still like the ETF, go for it! 🙂

Michiel

I’m extremely impressed with your writing skills as well as with the layout on your weblog. Is this a paid theme or did you customize it yourself? Anyway keep up the nice quality writing, it is rare to see a nice blog like this one these days.| а

Hello “windows xp professional sp3 official edition free download”,

I’ve deleted the link behind your name for obvious reasons, I’m sorry.

Besides that, thank you for your kind comment. I don’t see myself as someone with good writing skills and I though I had a lot of progress to make.

It is not a paid theme and most of the pages I customized myself. The front page is based on a template though!

Hi Michiel,

Thanks for writing this up, it’s a great article. I’m completely new in this field and would like to have your opinion. I’m 40yrs old and my goal is to retire at 60. So I have 20 years to invest. I can do monthly investments between 500 and 1000 EUR. I was looking to structure my portfolio with 60% of equities and 40% bonds. This is fairly straightforward and probably low risk. I was thinking maybe to risk a bit more and increase equities to 70% and bonds to 30%. What’s your opinion on this?

Hello Dragan,

First of all, being able to invest 500-1000€ a month seems like a decent amount. So, congratulations on being able to do that. The first step to retiring when you want and with a decent amount in the bank is saving as much of your income as possible.

To give you an example. If you invest an average of €700 each month for 20 years, assuming a return of around 5%/year, you could end up with €200.000 – €300.000. If you want to play with the numbers yourself check out this savings calculator!

Now lets get into your specific question. I see myself as a quiet aggressive investor. Which means I would want to keep my bond allocation as low as possible, as long as possible. Since you are still 20 years away from actual retirement I could even argue to go 100% equities and maybe switch to 20% bonds when you are 50yo and 40% bond when you are 55yo.

Off course this is just my opinion. Keep in mind that retiring is not really something I have thought a lot about so maybe do some more research in portfolios that are ‘designed’ for after retirement. I think a lot of it comes down to your own preferences. Bonds will usually give you less returns but will make your portfolio more stable. Downturns should not be as severe.

To end this (quiet long) comment with; How much risk are you willing to take? Do you want to go for growth aggressively? Will you be mentally fine when my portfolio dips 50% when you are 50 years old? …?

Think about these question and do enough research, also keep in mind that the ‘best allocation’ does not exist and you should go for the percentages that you feel the most fine with!

I hope this at least helps a little!

Hey Michiel

Quick question,

as a fellow Belgian, do we have to pay taxes on the money we make from investing?

Do you also have any plans in investing in real estate? As this can be a nice source of passive income as well.

Thanks for the amazing blog.

Keep it up!

Hello Jonathan,

You don’t have to pay capital gains in Belgium. This means that when you buy a stock and sell it for more some time later you will not be taxed on the money you’ve made.

You do pay taxed on dividends, 30%. This is why I buy accumulating ETFs. I never receive the dividends into my account so I do not have to pay taxes on them!

I haven’t done a lot of research on real estate investing in Belgium. What I do now is that real estate is quiet expensive here and you’ll need a decent amount of starting capital to get your real estate investment cash flow positive. What I mean with this is if you have to borrow a lot of money to buy the apartment or house you’ll probably pay more on your mortgage (and taxes and maintenance) than you’ll get from renting it out.

This being said, I would like to get into real estate eventually but this is still a lot of research and 10 years (or so) down the road.

I hope this answer was helpful. Don’t hesitate to contact me again if you have any more questions!

Thanks for your comment,

Michiel

Thanks for the response man!

Is there maybe a way to sign up for email notifications of your new posts? Would love to get those!

Since you’re also in the IT field, do you have any plans on becoming a freelancer? This could increase your monthly income by a lot even though it’s not the most stable source of income. But finding IT projects in Belgium shouldn’t be a problem 😉

Hello Jonathan,

I am actually setting up a subscriber option right now. I’m still looking for the best way to do it though. Once it is done I will put your e-mail in the list if that is fine for you?

To answer your second question. I just started working and I still feel like I have to learn a lot of stuff. Right now I still like the stability of a full time job and I don’t see that changing very quickly. What I do want to do is start some side projects. This blog is for example, although it is not something that makes me money, it could give me opportunities in the future.

Hello Jonathan,

Apparently there is no way for me to add you to the subscription list manually. If you visit the blog right now an popup should appear after 10 seconds on which you can subscribe if you still want to!

Sorry for the inconvenience!

Hey Michiel

I signed up, thanks. 😉

I’m in the same situation as you, building up some experience before starting to freelance. Who knows, we might run into each other in the future haha.

Quick question, how about taxes, you say that you don’t pay capital gains but there is the infamous TOB (taks op beursverrichtingen). Does DeGiro handle this well for you? Or do you use another broker?

I’m actually strongly doubting to start an account with DeGiro after what I’ve read about them.

– Only guarantees 20k money back if they screw up.

– No banking license.

– Recently acquired by flatex, a German broker -> what will happen to the fees?

– Shady MMF (money market fund) with negative interests – when your money is “waiting” to be invested, it loses value. Now they cover a part of that cost, but for how long?

If it’s true that they automatically withhold and register taxes, that’s a nice “pro”, but that’s about the only thing that’s attractive, apart from the low fees. The low fees can also be had at e.g. IBKR (interactive brokers) – much more solid enterprise (I feel) and better guarantees when they go bust (250k). The “con” for IBKR would be the inactivity fee of $10/month (waived when your assets reach >=100k -> Much cheaper overall than DeGiro once you reach this) and NO tax handling: you’d have to do it by yourself. Not sure how I feel about that.

Any ideas on how you handle these things? Choice of broker / handling taxes / risk management / Future scaling?

Did you register your account with the NBB?

Kind regards!

Hello ETFeling,

Sorry for the late answer. I was on a ski trip!

I do have to pay TOB indeed. Degiro does this automatically for me as well!

I understand your concern. The 20k money back guarantee does not apply on share I think. The share you own are yours even if the broker you buy them on goes broke. If this would occur you should be able to transfer your shares to a different broker. Although I don’t know how painful and slow this process would be..

A money market fund is not really a shady thing. The problem right now is that EURO MMFs have a difficult time right now with negative interest rates. You are correct that Degiro voluntary compensates the losses atm. I don’t keep cash in my Degiro account so this is not a problem for me at all.

All I can say is that if you don’t feel OK with Degiro go some place else. If you will not be able to sleep at night it is not worth it. Keep in mind that IBKR is very expensive for small accounts and it will eat away a lot of gains (maybe even create losses). This is why I’ll stick with Degiro for now.

I do think I’ll have to register my account for tax reasons. Although I have to look in to how to do it!

Kind regards!

Hi Michiel.

That’s a really useful article, great job 🙂

What do you know/think about investing in tax efficient pension funds and benefit from tax relief?

Kind regards!

Hello Victor,

I did the math myself when I was looking into saving in a pension fund myself. I don’t know where you are from but I’m from Belgium and my main bank is BNP Paribas Fortis. They have some pension options but the fees are extremely high. 3% every time I invest money, more than 1% yearly costs and 8% tax when I turn 60 years old. To keep it short, in the long run you will pay more in fees than you will gain from tax benefits.

My opinion is that you should just invest for your pension yourself you will not pay nearly as much fees and it is only a little bit more difficult.

Any more questions?

Michiel

Hey Michiel

Do you have any plans now that the stock market is rapidly decreasing in value (due to corona?) ?

I only just started investing this week and think it’s quite scary to already have a 200 euro loss.

Hey Jonathan,

This is a good question that a lot of investors probably have right now. Maybe I should make a separate post about it. The coronavirus is indeed causing quite a few factories to stay closed which causes supply chain issues for others. People are also less likely to go out on the street to buy stuff. This, off course, causes revenue to go down for a lot of companies. A lot of them have already announced that the first quarter won’t be that good due to the virus.

All of this could cause the economy to slow down and maybe slip into a recession. The federal reserve has already lowered their interest rates to try and stimulate the economy because they see that things are slowing down as well.

Let’s now talk about my plan during this market downturn and a possible recession in the near future. It is the easiest thing I can do. I will just keep doing the same. I would rather have a market downturn now, because I don’t have a very big amount invested, than a downturn in 3-4-5 years. The only thing I hope is that I won’t lose my job if things go really bad. Other than that I will just keep investing the same amount every month.

When you start investing you should know that things like this can happen. As my portfolio invests in the total world stock market, the only bet I’m really making is that the world will be further along in 20-30-40 years. I still think this is the case. Just take to opportunity to buy shares at a cheaper price!

Good – I should certainly pronounce, impressed with your site. I had no trouble navigating through all the tabs and related information ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or something, website theme . a tones way for your customer to communicate. Excellent task..

Hey,

I have a question, is it still necessary to split the first two ETF’s as you have stated. I am new to this and was reading a fair few articles including your blog posts and I was thinking to invest in the following Vanguard FTSE All World ETF. Would this be ok too rather than splitting the two?

In addition to this I would also look at the small caps you mentioned.

Also I want to invest in bonds too…. do you have any advice in regards to this?

Hi Hinesh Modi,

Great question. You can easily invest in the ETF you’ve mentioned instead of splitting it up like I did. The reason I chose to split is up, was to have a little bit more freedom in my percentage allocation. The TER (annual costs) are also a bit lower when you split them but this will be almost insignificant. If you feel better picking one ETF, go for it! 🙂

I chose small caps as a third fund but this is not at all needed. The reason why I want to add it to my portfolio is to not only be diversified geographically but also between company sizes.

For bonds, I won’t be of great help… Since I’m still quite young (23yo), I’ve chosen to not invest in bonds right now. If you want to invest in bonds I would advise you to pick a fund that is greatly diversified between government and corporate bonds.

Good luck!

Hey,

Thanks for the quick response!

I am still torn between your strategy and the one I found one another site (Index fund investor)

I will have a good think as I like many aspects of your strategy too. Maybe I will go with a single all world etf and then small caps like you…. but I need to do more research.

Thanks I will look into bonds, to be honest I would like to invest the Gov Bonds where I currently live (Czechia) but this is for the future.

I have had a little read about P2P lending… is it still a good idea? How risky is it?

Thanks again!

Hi Hinesh Modi,

You could indeed just buy the single all-world ETF. Nothing wrong with that at all. Probably the single most easy strategy you can go for! Adding small caps is indeed a choice you have to make for yourself. Do some research and decide after. 🙂

You can indeed just buy government bonds of your home country, don’t see anything wrong with that although I would personally decide do diversify a bit more.

I recently made a post about my current view on P2P Lending and what my strategy is, going forward. You can check it out here. To say it as short as possible. I still believe P2P Lending to be a viable investing market but during the strange times right now I’d prefer to be at the side-lines. This way we will be able to see how the P2P lending market will develop and whether it can thrive in times of crisis as well.

The The perfect ETF portfolio article is one of

the best I have ever read!

You are doing a great job with https://www.investingyoungster.com site.

🙂 KIsses!

Hello what are your thoughts on VHYL is it worth investing long term just for dividends I know that’s very diversified

Hello Giorgos,

I did a quick comparison and came to the following conclusion:

– VHYL has a smaller fund size than IWDA for example. (It is still quite large but the larger the better in my opinion)

– VHYL has an expense ratio of 0.29% which is higher than what I prefer (Iwda is 0.20%)

– VHYL has performed worse since 2013 than IWDA by quite a big margin even including dividends. (Even though past results are not an indicator for the future but it does tell us something.

– In a lot of countries, dividends are taxed quite heavily (I live in Belgium where this is the case). This is why I prefer accumulating ETFs. This way I’m not taxed on the dividends which would be the case if I would invest in VHYL for example, which does distribute the dividends.

It is certainly not a bad ETF, but not the one I would pick!

Michiel

Hi Michiel,

I am a 19-year-old Irish guy and I started to learn about investing back in April and I am now learning every day. I’m not sure if you are aware but taxation on ETFs in Ireland is shockingly bad… subject to CGT every 8 years regardless if you buy/sell/hold. I have a couple of thousand I am looking to invest in a couple of weeks time and I think it will be roughly something like this: 60% IE00B4L5Y983 30% IE00B2QWCY14 10% IE00B4L5YC18. What are you’re thoughts on this?

Hi Sean,

Thanks for your question! I’ve heard that taxes on investing in Ireland or not great at all..

The ETFs themselves don’t look bad at all. You want to go for the following:

-60% developed world large caps (acc)

-30% US small caps (distr)

-10% Emerging markets large caps (acc)

The one I don’t really like is IE00B4L5YC18. This is for 3 reasons:

1. 30% of your portfolio will be small caps, which in my opinion is a bit too much.

2. This ETF only covers US markets

3. This ETF is distributing (but maybe this doesn’t matter tax-wise in Ireland?)

Anyway, there is no real way to say which portfolio will perform the best and which regions will do better. If you would want these 3 ETF’s I would go with an allocation that would look something like this:

60% IE00B4L5Y983

20% IE00B2QWCY14

20% IE00B4L5YC18

(or maybe even 70-20-10)

Anyway, it is still your decision but I hope you like my input! 🙂

Kind regards,

Michiel

Hi there,

Thanks for this post, it is very interesting.

I am starting to invest and I am a bit lost defining a strategy.

The ETF plan looks promising, but how does it compare to a fund?

What is the advantage to a fund replicating indexes, for example, Amundi Index MSCI World AE-C?

thanks

Hi David,

Sorry for the super late response. I was enjoying some holidays!

An ETF is actually a fund. These funds regularly replicate an index. For beginner investors, I definitely recommend ETF as they are an easy way to get exposure to the whole market and in this way enjoy the same gains (or losses). Depending on where you live, your strategy could be a little different.

1-2-3 ETFs are all you need to be a good long term investor. All you have to do is buy once a month and you should be good! 🙂

If you have any more questions, don’t hesitate to ask!

Kind regards,

Michiel

Hi Michiel,

New follower over here and loving your content! 😉

Question: for someone choosing to go with just VWCE instead of the combo IWDA+EMIM, and since VWCE is not on the “free ETF” list on Degiro, what would you say is the best way to invest in this ETF? I´m thinking perhaps 2/3 times in the year, instead of monthly contributions.

I would like to have an excel to help me calculate this difference. Do you know how it can be done?

Many thanks in advance.

Hi Ana Silva,

VWCE is definitely a good way to go as well! There is very little difference between VWCE and IWDA+EMIM. The reason why I picked IWDA+EMIM are the following 3 arguments:

-The freedom to add a bit more Emerging Markets exposure

-IWDA being free on Degiro

-The combined TER is a little lower than VWCE

That being said, VWCE is the easier choice and probably (almost) equally as good! Depending on your monthly investment amount it might be better to buy as soon as you can. You should look at the average gains of the ETF + the fees that you would pay. Throwing this in an excel sheet could show you the ‘best’ buying strategy.

I am always glad to help you out with the excel sheet! Just send me an email with your monthly available investment amount and I’ll check the math for you!

Kind regards,

Michiel

Amazing post! Quick question: I see there are 3 different currencies for those ETFs. In this case, let’s say I’m investing in euros, wouldn’t be better to invest in funds based on euros already? Thanks Michiel for sharing!

Hi Breno,

You should buy the fund that is trading in euros. Otherwise, your broker will probably charge you some currency conversion fees, which means that you will be paying extra!

I hope this answered your question?

Kind regards,

Michiel

Hey Michiel! It does 🙂 actually I’m using Trading 212 and it doesn’t charge any exchange fees. Here’s what I see:

* IUSN -> EUR

* EMIM -> GBX

* IWDA -> USD

So I wonder if for example it would be good to change for this:

* IWDA -> EUNL

* EMIM -> IS3N

Or even replace both for VWCE. Although they should have similar rentability, they are actually so different I got confused.

Thank you so much Michiel!

Hello Breno,

For some reason, I just notice this last response now. I am so sorry for not getting back to you sooner. How is your investing journey going so far, have you been able to pick the right ETF(s) for you?

If Trading212 does not charge any exchange fees, you could buy with whatever currency you’d like! You can also go for VWCE which is a perfectly fine ETF as well!

Kinde regards,

Michiel

Hi,

Assuming I build a portfolio in Degiro of only two ETFs: 75% Word + 25% EM, which EM ETF would you recommend: iShares Core MSCI Emerging Markets IMI UCITS ETF (Acc) on EAM (online quotes but lower liquidity) or on XET (greater liquidity) or iShares MSCI EM UCITS ETF (Acc) on EAM (free in Degiro but low liquidity). Which will fit better with the IWDA?

Grzegorz

Hi Grzegorz,

They are both great choices. I’d buy on EAM because IWDA is on EAM as well and this way you won’t have to pay the extra €2.5 to Degiro.

The choice of the ETF itself is a bit harder. iShares Core MSCI Emerging Markets IMI UCITS ETF (Acc) tracks a larger index than Ishares MSCI EM UCITS ETF (Acc). This means it includes smaller capped stocks as well. You have a bit more diversification this way. That buying said, if you compare the to ETFs, returns will be almost identical. TER is also the same for both of them. The biggest difference is that, indeed, the latter one is free one Degiro while the first one is not.

I went with iShares Core MSCI Emerging Markets IMI UCITS ETF (Acc). It is indeed not free but the fund size is a lot bigger which gives me more confidence that the fund will not be closed any time soon. Also, EM is a smaller part of your portfolio so you won’t be buying it that often, so you won’t pay a lot of fees anyway.

Both ETFs are a fine choice! It’s up to you whether you pick that bigger fund size over lesser fees.

Kind Regards,

Michiel

I’m from the UK. Is it worth to invest in IWDA Instead of SWDA? Or does it matter? I know one is Pounds and another is Dollars.

Should I sell my IWDA And replace for SWDA? If I do sell, It would be a fee.

Thank you for reading

Hi Tycho,

Good question! SWDA and IWDA are actually the same ETF. The only thing you need to look at is the fees. If you buy IWDA you are converting your Pounds to Dollars. Depending on your broker this could mean that you are paying fees for your conversion. If this is the case it could be better over the long term to buy SWDA from now on. You don’t actually have to sell the IWDA you already own. Just keeping them both is a possibility as well?

U hope this answered your question? If you have any more, feel free to contact me! 🙂

Kind regards,

Michiel

Hi Michiel,

Thank you for your help and your response.

hi,

Any reason why to invest in IWDA instad of SUSW? I’m looking for a big weight ETF for my portfolio and found out that SUSW is practically the same as IWDA, but more sustainable (futureproof?)

Kind regards

Hi Olivier,

SUSW indeed looks like a very decent ETF. It is basically the same as IWDA but it keeps away from controversial companies with a good environmental, social, … policy. The fund is quite a bit smaller than IWDA but this is not the most important thing. I’d say it is a very good ETF to make up a big part of your portfolio!

Kind regards,

Michiel

I’m 20 years old and new to investing.

I worked for a bit and have a decent amount of money on account.

So to start i want to buy these etf with around 10k. Should i just sepnd the whole 10k or divide it over monnths?

I will later add more to it, at least double it.

Hi Macaroni,

I see you added your comment multiple times! 😉 I have to approve it first to avoid spam etc.

It looks like you are doing pretty well at a very young age. I’m getting kind of jealous already! To answer your question: There is really no ‘best’ way to do it. History shows us that it is most of the time better to invest it all at once but you are taking more risk here as well. Certainly, if you are completely new to investing and the stock market, I would recommend spreading out your investments over a couple of months. You will have to get used to the ups and downs of your portfolio and this could be very hard for some people. Buying 2k every month for the next 5 months or even 1k over the next 10 months will give you some time to learn how the markets work while slowly increasing your positions and daily swings.

I hope this answers your question? If you have any more, don’t hesitate to get in touch once again!

Kind regards,

Michiel

Hi Michiel,

Thanks to your great blog amongst all my other research I have done, I am happy to have started a position in IWDA AND EMIM.

I am planning to make large lumpsums into Degiro for these two ETFS. I am not concerned with Small Caps. I don’t feel comfortable lobbing a large block of cash in in one go so I will just put in large chunks each month or lumpsum it all in when I feel comfortable.

How do you rebalance?

I will probably only buy EMIM twice a year to keep costs low. Does it really matter if they percentages are not exactly like 85% IWDA 15% EMIM. If I only buy EMIM once or twice a year, they will probably get a little out of balance to the perfect ratio, if you understand.

What is your strategy? Thanks

Hi Patrick,

Small caps are indeed not necessary at all! I chose to add them just for that little bit of extra diversification. Another reader asked me a couple of days ago about IEMA (IE00B4L5YC18) instead of EMIM. This could be a could emerging market ETF for you as well. EMIM actually covers small caps as well while IEMA doesn’t. IEMA is on the Degiro free list as well (I am actually going to add it to this post as well).

To get to your actual question: I simply check every month which ETF I should buy to get as close to my desired allocation as possible. Indeed when you are just starting out this means that the allocations will fluctuate quite a lot. Once your portfolio starts growing, these monthly buys will be a smaller and smaller percentage of your portfolio and you’ll get a more steady allocation.

I hope this answers your question?

Kind regards,

Michiel

Thanks

I have not added any emerging markets. IEMA that was previously a very high TER but is now lowered right?

Are you suggesting that IEMA is a better pick now than EMIM?

Granted then my whole portfolio would have no broker costs which might be nice, even though EMIM is not very expensive if you buy it sparingly.

I must do some research on IEMA, what would be your view if you were starting now? Will you change your EMIM to IEMA?

I have only added IWDA for now. I’m 27 and started last month.

Cheers!

Hi Patrick,

The TER of IEMA was indeed lowered last year. If I were to start now I probably would go with IEMA. Maybe I should even consider switching now. That being said I still like the small caps in my portfolio which EMIM provides for emerging markets as well.

If you don’t have the need to add small caps, which is totally reasonable, I would suggest you go with IEMA. IWDA + IEMA is probably the only thing you really have to buy for the rest of your life and on Degiro you can do it for free. How perfect is that!

27 is still quite young! Good on you for starting the investing journey. I wish you the very best, if you ever have any questions or want to talk about investing or money in general, hit me up!

Kind regards,

Michiel

Hi,

I see your actual portfolio and I see you added two stocks to it.

Why is that? are you starting to invest in single companies?

cheers,

Hi David,

I had a bit of extra money a couple of months ago and decided to buy a little bit of 2 different companies. I see this more as ‘play money’ and I wanted to test out a different platform as well.

As you can see I only invested €100 in each stock which means that this is a very small part of my portfolio. I would not recommend having more than 5-10% of your stock/ETF-portfolio in single companies. Naturally, this is something everyone has to decide for him- or herself. 🙂

Kind regards,

Michiel

Hi,

It’s me again 😉

I’ve been checking a bit further

Why not the SWRD

https://www.justetf.com/uk/etf-profile.html?isin=IE00BFY0GT14

instead of the IWDA?

the TER is 0,12. It’s quite significant difference compared to 0,20

cheers

Hi David,

SWRD is certainly a good option! It did not exist when I started investing though. I also think it is not free to buy on Degiro which could counter the cheaper TER. That being said, it is a perfectly find ETF in my opinion 🙂

Kind regards,

Michiel

ahá

I understand, because of the broker. It makes sense!

thanks

Hi Michiel,

I really liked your article and I really appreciate you doing it and I am going to take two of the named etfs. I am starting in this and I don’t know whether to diversify my portfolio or go only with IWDA. I am 25 years old and I would like to make monthly contributions of 300-400 euros.

My diversified portfolio would be

IWDA: 70%

IEMA: 15%

QQQ: 15% (LU1829221024)

What do you think of adding as 3 etf QQQ and of the percentages that I have put? Would you add more or take away from some?

Thanks and regards

Hi Alejandro,

First and foremost, good for you on starting your investment journey early!

I would personally not add QQQ to my portfolio. This ETF invests in de top 100 companies of the NASDAQ and those are already included in IWDA. The only reason you would want to do this is if you want specific extra exposure to the NASDAQ. If this is a decision you have thought well about, go for it!

Kind regards,

Michiel

Thank you a lot for this post, really.

I have two doubts:

a) If IWDA and IEMA are both in the Degiro’s free of comission list, can I buy them both in the same month for free? Or is it ONE free transaction only?

b) If you were starting now would you go IWDA + IEMA + IUSN on Degiro? Isn’t IEMA instead of EMIM, in the long run, be way more cheaper since it is in the free list?

Thank you!

Hi Faju,

Thank you for your comment!

a) Yes you can buy them both for free in the same month.

b) EMIM also covers small caps of emerging markets. This is something I wanted in my portfolio as well. That being said IEMA had a much higher TER when I started. This is why I chose against it. That being said, both are viable options. IWDA + IEMA is the more simple and probably the cheapest choice but you will not have small caps.

I hope this answers your questions?

Kind regards,

Michiel

EMIM is also on Degiro free list now 🙂

Hi Grzegorz,

I saw it as well! Good news! 🙂

Kind regards,

Michiel