Another month, a little bit more wealth! Slow and steady wins the race. It was again not a super exciting month, investment- wise. I stuck to my plan like I should and reached a personal milestone of having €10.000 in the stock market! Let’s take a closer look at the numbers!

Don’t forget that you can always find an up to date overview of all the ‘numbers’ in my portfolio on the My Portfolio page.

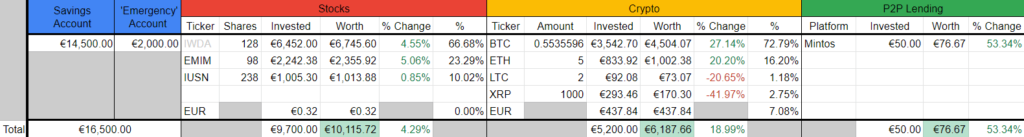

Portfolio overview

Every category is still in the green! This month I bought IUSN for the first time which means I now own the three ETFs I talk about in my ETF portfolio post. I’m still thinking about whether IUSN should be 10% of my ETF portfolio or if I should rather go for around 5%. Right now I prefer 10%.

Keep in mind my P2P lending portfolio (if you can still call it a portfolio) still shows a positive result. At the moment I only have loans from two companies left. Both companies are enduring some problems at the moment so it could take some time before I get my money back, if at all. I’ve made a small update on my P2P lending portfolio here.

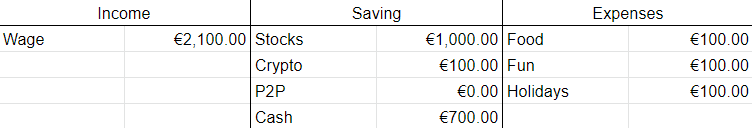

Monthly Cash-flow

Monthly cash-flow is still the same. I am still cashing out P2P investments. I am investing most of this money in Bitcoin which causes my monthly Cryptocurrency investments to be slightly higher than ‘the plan’.

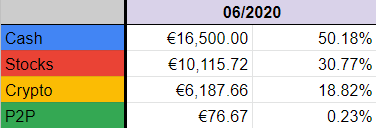

Portfolio Allocation

- cash: Saved €800

- Stocks: Invested €1000 + €284.42 appreciation

- Crypto: Invested €200 – €305.81 depreciation

- P2P: Withdrew €200 – €2.56 secondary market fees from selling loans

As I’ve said before, stock market milestone of €10.000 reached! Normally, I want to save €1800/month. This month it came down to €1690. This is because I started an official side hustle. I’ve put €300 aside to give this a start! I hope this will give some returns In the future. I’ll give separate monthly updates on the income and costs of my small business in the future so you can tag along and hopefully see my business grow in real-time, as well as my possible mistakes!

Overview

Investing-wise this wasn’t a very exciting month, but I guess this is not a bad thing at all. At this rate I’ll have €100.000 invested in 2023. I have some challenging times ahead though. I have no idea how things will go ones I buy an apartment. I still have a lot to learn but I’m excited about what my financial future will bring. I am very curious about where I will be in 10 years!

Hi

Just wondering, how do you keep track of your portfolio? Just a spreadsheet you update monthly?

Ik started using a spreadsheet too, but it’s pretty static and annoying to update. Wish my banks & broker had an API which I could connect to an app (with Bitcoin portfolio included). Would be nice ?

Hi Vincent,

Sorry for this kind of late answer. I was in the Ardennes for the weekend. I use a Google Sheets spreadsheet indeed (you can check it out here).

It keeps track of the current prices automatically via google finance (built-in) formulas, even for my cryptocurrencies (except XRP). I do have to put in my buys myself, but I don’t really mind. I also have tabs for every half-year. This way I can track whether I follow my budgets and project into the future as well.

I’m not completely happy with it, but it is doing the job right now. 🙂

Michiel

Nice ik ga dat schaamteloos kopiëren ?

No problemo, ga je gang! 😀

Done, looks a lot better than my spreadsheet ?

I put my pension fund under stocks, but there’s no google finance integration for ARPE I guess + it’s too complex to calculate what I invested every year so far + tax reduction etc.

Doe jij niet aan pensioensparen? Of zie je je stocks als je eigen pensioenspaarfonds?

Hi Vincent,

Certainly not every fund/stock works with Google Finance, unfortunately!

I looked into ‘pensioensparen’ myself a while ago with my bank (BNP Paribas Fortis). Their funds had high entry- and yearly fees. Together with the 8% (?) you have to pay in taxes when you turn 60 (?) I found out that I would pay more in fees over the years than I got back from taxes yearly. You also don’t have the freedom to access the money when you would want to (or you pay a lot of taxes).

That being said, there are a lot of cheaper options out there that are probably worth it, certainly when you would invest the tax benefit that you get from ‘pensioensparen’. I would like to own my own pension account with the same rules and regulations but with the freedom to invest in what I want. But I don’t think there is a real option to do that?

I should do some more research when I find the time!

Michiel

You might be right. I believed the bank and the government when I started my pension fund. When I look at it that way I feel like an idiot ? Never heard of trackers back then.

Hi Michiel,

Where do you buy EMIM & IUSN shares to reduce the costs? At this moment I’m only active on Degiro. IWDA is in the ‘kernselectie’ of Degiro, the other 2 ETF’s have a higher cost to buy on their platform.

Also I like to know how you the ratio for your 3 ETF’s besides the geographic spreading as I find different ratio’s online for this combination.. (75-12.5-12.5), (70-20-10),..

Keep up the good work with your blog posts! ??

Hello CoppiePaste,

I buy EMIM and IUSN on Degiro as well. I have another post about the ETF portfolio I want to go for. There, I talk about 75-20-5. It this point in time I want to go for 70-20-10.

Because of these smaller allocations I’m only buying EMIM around 2-3 times a year and IUSN around 1-2 times a year. This means that it won’t cost me that much. The fees are not that high anyways!

Thanks for your comment, I hope this answered your question. Sorry if my reply contains some mistakes, I’m answering from my phone 🙂

Kind regards,

Michiel