Hello, fellow (starting) investors. Today I will try and explain the basics on how you can start investing. The emphasis will lie on stock market investing but I believe you can take these tips and apply them on other investment vehicles as well! You are probably here because you are very new to investing and you feel kind of lost without a real place to start your journey. I will try and explain the steps to you as simple as possible! Let’s learn how to invest!

Step 1: Your financial situation

A very important first step is to look at your financial situation. Are you financially stable? Let’s take a look at some questions you’ll have to be able to answer with a ‘yes’ before you can start investing.

Do you have a (steady) stream of income that easily covers your monthly expenses?

If you are living paycheck to paycheck chances are you have other problems that you have to look into first. Maybe you are spending too much money on stuff you don’t really need? You could also try and invest in yourself first. This way you can look for a better paying job. You could also pick up extra work on the weekend. (I, for example, have an extra job working in the kitchen of a local restaurant on Saturday evenings). I have another article with some suggestions on how you can save money as well!

Do you have a financial buffer saved up for unforeseen situations?

This is better known as an ‘emergency fund‘. It is strongly recommended to always have some cash saved up for emergencies. Depending on where you live and your situation, the recommended size of this fund should differ. This money could be used for medical situations, car/home repairs, … It could also be used to live on while you are in between jobs. A lot of European countries have great safety nets for these kinds of situations while this is not the case in the USA, for example. I’d recommend 6 months of expenses, but you can easily go for more or less depending on your situation and needs.

Have you paid off all high-interest debts?

High-interest debt should always be paid off before you start investing. Maybe you have some credit card debt at the moment? These could easily come with an interest rate of 10%. This means that this interest will probably cost you more than the returns you will have in the stock market. Always pay off high-interest rates before you start investing!!

You will not need the money in the next couple of years?

Maybe you have quite a lot of cash saved up because you want to buy a house/apartment in the near future. In this case, I won’t recommend investing this money. Your money could easily be worth way less at the time you want to buy your place to live. Invest only what you will not need in at least the next 10 years!

Alright, if you are able to answer ‘yes’ to all the questions above, your financial situation is quite good already. You are on the right path! If not, try and get your finances in order first. This is very important because investing carries a certain risk and you don’t want to be put in a position where you will be forced to sell your investments

Step 2: Your investment portfolio

This is probably the most confusing step. If you don’t know anything about the investment world it can be hard to know where you should put your money. I will mainly talk about stocks since this article is mostly directed at the stock market.

The stock market contains a lot of different companies whose shares are traded publicly. This means that anyone can buy 1 or more shares and in this way, they become the owner of a small part of the company. Depending on the company the price of these shares can differ. If a company is worth €1000 in total and the total amount of shares is 10, each share will be worth €100. The share price is determent by the market. This means that people like you and me cause the price to go up or down. If a lot of people want to buy shares of a company (because they are doing very well), the price will go up. The same is also true the other way around. This is simple supply and demand.

The question still remains.

Which companies should you buy? I would always recommend ETFs, especially to beginner investors. To put it simply, an ETF is a basket of different companies. This basket also has a share price itself. This means that if you buy a share of an ETF, you are actually buying a lot of different companies at once. I actually have another article that deals in depth with what an ETF is. You can check it out here. You can easily buy 1, 2 or 3 different ETFs and be invested in practically the whole world. This way you are very diversified which decreases your amount of risk! If you want to know more about my ETF portfolio you can check out this article as well! JustETF is A very good website where you can research ETFs!

There are 2 big types of ETFs available. The first one is called accumulating ETF, the second one is distributing ETF. This can sound very daunting the first time you hear it and if you want to know the difference more in depth, you can check out this article. I will try and explain it in short here as well. A lot of companies pay out dividends every month/quarter/half-year/year. This means that cash gets credited to your account when you hold one of these companies. This is a taxable event in a lot of countries.

Dividends and ETFs

If you hold an ETF (which is a basket of companies), these cash dividends are deposited in the account of the ETF manager. This is where the difference lies! An accumulating ETF will use this cash to buy new shares, a distributing ETF will credit the money to your personal account! In a lot of countries, it is tax-efficient to use accumulating ETFs because no taxable event is triggered this way!

One thing to know is that I can only help you so much with the building of your portfolio. Everyone needs to determine the following things to consider what they will invest in: Age, country of residence, risk appetite, tax laws, …

Very popular ETF portfolios in Europe are the following 2:

- IWDA + EMIM (developed markets + emerging markets)

- VWCE (1 ETF containing developed and emerging markets)

Step 3: Strategy

Once you have your portfolio figured out, you can start thinking about your buying strategy. How much of your monthly income do you want to invest? Do you want to invest on a monthly basis? Maybe you rather invest every couple of months. I invest a certain amount of my income every month. For me, it does not matter what the price or market conditions of that moment are. That is the beauty of passive investing. Try to invest as much as possible, when possible, and forget about it for at least 10 years!

Step 4: Opening a brokerage account

Yes, it is possible to invest with your normal bank most of the time. But, you need to know that most mainstream banks charge you a lot of fees when buying and selling shares on the stock market. Fees are very important factor when you are looking for a broker/bank where you want to invest your money. Secondly, not all brokers will be available in all countries. This will be something to look for as well. One of the most popular brokers in Europe is Degiro. They charge very minimal fees and are available in most European countries. Degiro is the broker that I use myself. I have heard that Trading212 is another one that is getting quite popular right now.

When looking for a broker think about the following things:

- Costs

- Availability in your country of residence

- Reputation (+ how long is this company in operation)

Step 5: Buying shares

Once you’ve opened your brokerage account and have gone through the verification process, it is time to start buying those precious shares! The first step will be transferring money to your brokerage account. This should not be difficult and you’ll easily find it at the broker you are using.

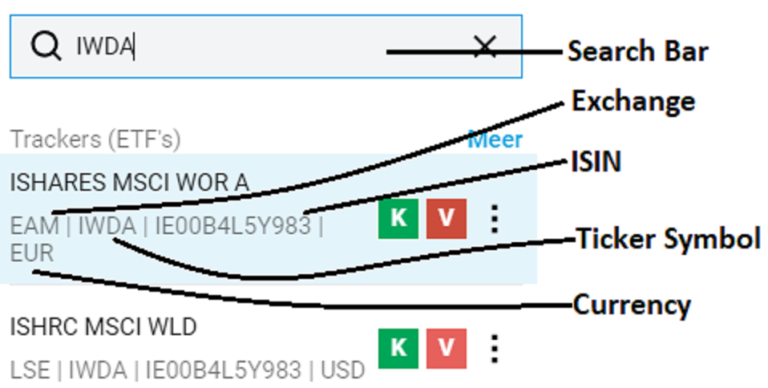

Every broker should have a search bar. This is the place where you can look for your ETF/company. Every ticker that is traded on a stock exchange has a ticker symbol. These are usually a few letters. Apple uses AAPL for example. The ETF that I buy the most uses IWDA. You should be able to find your ETF/company using the ticker symbol. Every ticker also has a longer ISIN code. This is a longer unique code with which you are able to find your specific ETF/company. For IWDA, the ISIN is IE00B4L5Y983. This information can easily be found on Google if you are looking for a specific company.

Multiple exchanges?

It could happen that your shares are traded on multiple exchanges. IWDA is traded on the EAM (Euronext Amsterdam) and the LSE (London Stock Exchange) for example. It doesn’t really matter which of the two you buy but there are a couple of things that could influence your decision: In this case, IWDA is traded in EUR on EAM and traded in USD on LSE. Since my main currency is EUR, I would want to buy on EAM because otherwise, I will have to go through a currency conversion which could bring extra fees. You should also think about the fees connected with the exchanges. Brokers could charge a different fee depending on which exchange you buy!

You are ready to start buying!

Once you have found your specific company or ETF you are ready to start buying! There are different order types when buying shares. The most important ones are market orders and limit orders. In short, market orders mean you are buying at the best available price at that moment. For limit orders, you will have to specify a buy price. Your order won’t be executed unless the share price reaches the one you specified.

The easiest one to use is a market order. You only have to specify the amount of shares you want and press buy! There you go, you are now an official investor! Good luck and if you have any more questions, don’t hesitate to let me know!