What a month!!

Hello everyone. March has been a crazy month. We have weathered some of the biggest daily gains and losses the market has ever seen. Some of you might be scared and understandably so. I have taken the opportunity to buy some more shares as well as cryptocurrencies while they were at lower price points. This does not mean that I think we have hit the market bottom. Let’s be honest here, I have no idea when or where the bottom will be. My strategy is to keep buying every month and if we see some more sizable losses I will, again, take to opportunity to buy some more.

I have chosen to slowly liquidate my P2P Lending position though (for now). More info can be found in this post I wrote last week.

Don’t forget that you can always find an up to date overview of all the ‘numbers’ in my portfolio on the My Portfolio page.

Portfolio overview

As you can see I have €530 that is already on my Coinbase account. This is already there to buy more bitcoin over the coming weeks. The strategy here is to buy more when the price goes lower and buy less when prices rise or stay relatively the same.

Monthly Cash-flow

My cashflow and savings plan is still the same as last update although this month I’ve done some things differently. I will elaborate more below.

Portfolio Allocation

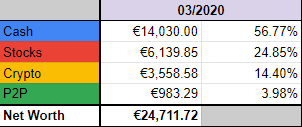

This is my portfolio allocation at the end of March 2020. I will always check if I reached my savings and investment targets (as seen by the ‘OK’ / ‘NOT OK’ below) as well as the changes in the value of my investments. This month I can’t really check whether I reached my savings targets since I deviated from my standard monthly contributions.

- cash: I took cash to invest in stocks and crypto so I actually have less cash on hand than last month (€14.550)

- Stocks: Invested €1000 (in the middle of the month to take advantage of low prices) + €1500 at the end of the month + €327.02 depreciation

- Crypto: Invested €620 instead of €150 + €1041.31 depreciation

- P2P: Invested €0 + €5.94 appreciation

As you can see, this month was quite different. To be fair these are not normal times as well. Both my stocks and cryptocurrencies saw prices go lower by quite a big amount. I’ve invested a lot more in them because of this reason. Nothing guarantees that we have seen the worst already. I still have enough cash on hand to invest even more if we would keep on going down a lot.

I will probably keep on buying more Bitcoin in the next weeks than I normally do. If prices continue to fall I’ll try and scoop up one whole bitcoin in the process.

Overview

I feel like this post was a bit messier than a normal portfolio update. This month was a roller coaster ride as well which could be far from over. I am prepared and I have a plan for what I will do in the coming weeks and months.

- Buy more stocks than usual when we see sharp declines

- Try to get 1 BTC when prices allow it

- Sit on the sideline of the P2P Lending markets as much as possible