Overview

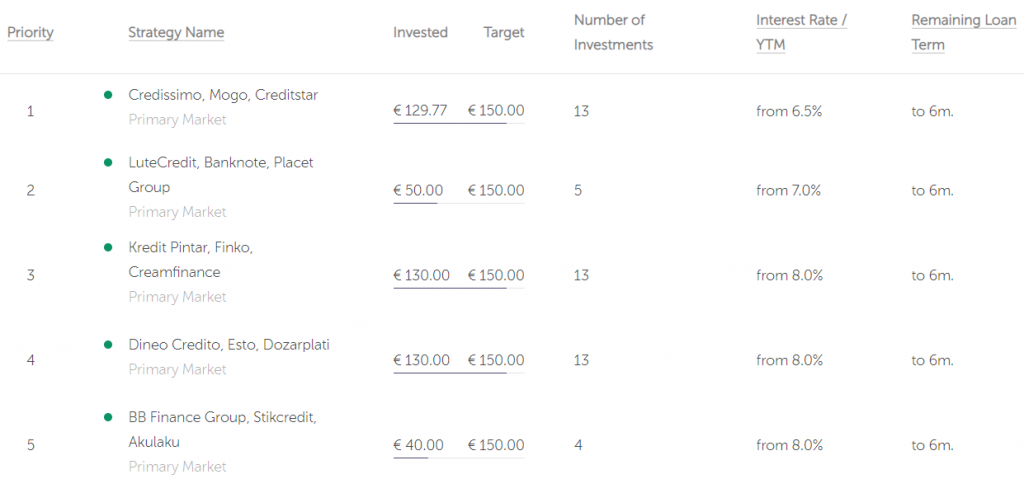

As you can see, after selecting my lending companies, I make groups of three loan originators each. Starting with the ones that have the best P2P rating because I want to prioritize the ‘best’ companies over others (that I think) are a bit worse. Again you can find the P2P ratings that I am talking about in my other post. For each group of three companies I make a separate strategy. Each strategy effectively does the same but this way I can make sure every company is equally weighted while still giving priority to the best ones like I’ve mentioned before.

Keep in mind that you only select companies, countries, loan types, .. according to the rules you’ve chosen. This post will not get more in-debt into that topic.

Strategy settings

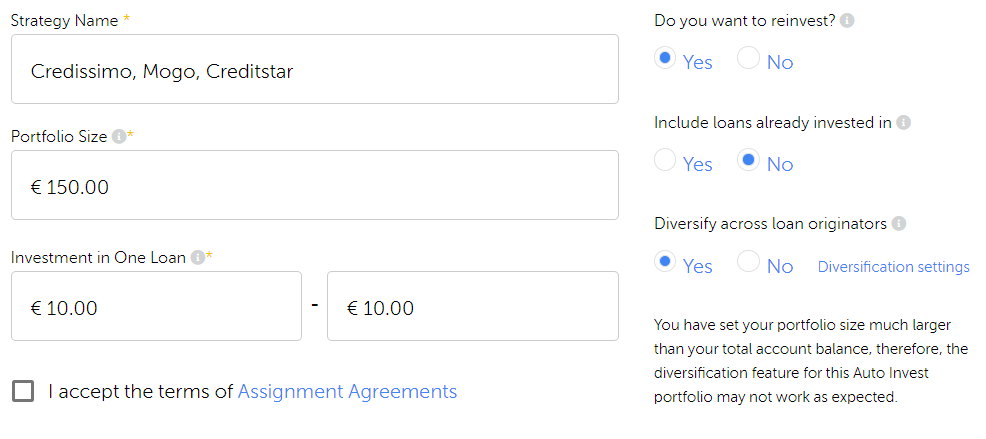

Here you can see the extra strategy settings. I make sure to set my all portfolio sizes equal according to my total portfolio value. I want the investment in every loan to be as low as possible so I take the lowest possible amount of €10. This will make sure I can invest in as much loans as possible.

I also make sure to not invest in loans that I have already invested in to diversify as much as possible.

The most important option here is the “Diversification settings“.

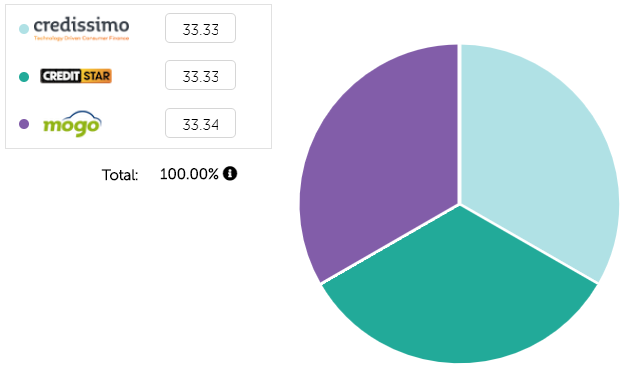

Mintos will automatically diversify across loan originators according to how much loans they have outstanding. This could mean that it will invest 90% of your strategy/portfolio value in one company while investing almost nothing in the other two.

I would advise to make them all equal. This way your exposure to one single lending company will not get to big.

As you can see, creating an auto invest strategy on Mintos is not difficult at all! If you would have any more questions, don’t hesitate to leave a comment or get in contact with me!

Good luck!

Hey what is the situation when it comes to taxes and P2P lending?

Hey Hinesh Modi,

Sorry for the super late answer. Apparently your comment got lost. P2P Lending income taxes are still unclear in a lot of countries because it is still so new. My guess is that most countries treat it as interest income. This means that it probably is kind of the same as income from your savings account. In Belgium, this means that if you earn more than a certain amount, you will be taxed.