Hello Investors. Another month has passed, let’s take a look at how my portfolio performed in this portfolio update for October 2020! This month was quite a nice month for my overall portfolio. The stock market has had some losses but these were more than made up for by the cryptocurrency part of the portfolio. Proof that diversification is key!

Don’t forget that you can always find an up-to-date overview of all the ‘numbers’ in my portfolio on the My Portfolio page.

Portfolio overview

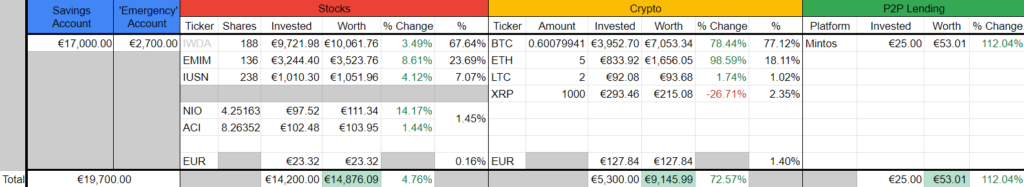

As you can see we are still in the green across the board. My ETFs went down a bit during the month due to COVID getting worse all over the world. A lot of European countries are in (semi) lockdown again, including Belgium starting tomorrow.

The cryptocurrency part of my portfolio is certainly performing the best. It is up around 70% at this moment while the stock part of my portfolio is up around 5%. I’ve always said that cryptocurrencies are a riskier and more volatile investment. The other side of that coin is potentially a higher reward. This is something that we are seeing right now and I do think that there is still a lot of room to grow. But who am I to make that prediction, right?

My P2P lending portfolio is almost totally liquidated. I am thinking about completely removing it from the spreadsheet since I have only €25 of my own money still on the platform.

Monthly Cash-flow

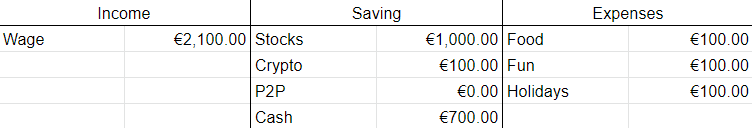

My monthly cash-flow is still the same this month. This month I invested €1200 into the stock market instead of €1000. I had some extra money leftover due to spending almost nothing. I decided to put €100 in two different stocks just to have some fun and to learn a bit more about stock picking. You can read my stock analysis on Albertsons (ACI) here!

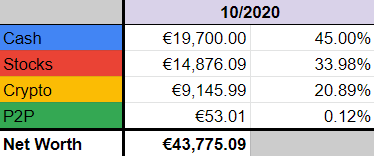

Portfolio Allocation

- Cash: Saved €700

- Stocks: Invested €1200 – €273.23 depreciation

- Crypto: Invested €100 – €1863.14 appreciation (!)

- P2P: Transferred €15 to my bank account

Overall, you can see that this was a pretty decent month. Not counting the P2P transfer I’ve invested €2000 this month which is quite a lot! If only I could do that every month! If everything goes well, I should be able to pass the €50.000 mark at the beginning of 2021!

Overview

This was it again for my portfolio update of October 2020. If you have any questions about my portfolio or investing in general, please feel free to leave a comment down below or contact me personally. I am always very glad to help a fellow investing enthusiast!

Hey Michiel!

First of all, thanks for sharing your portfolio update each month.

I have a question. Do you invest at the beginning of each month (let’s say the 1st of the month) regardless of market price, or do you “wait” for some kind of dip in the market, each month, to invest?

Hello Alex,

I always invest when my paycheck arrives in my account. For me, this means that I invest at the end of the month.

I don’t look at the market price at that moment. A big part of my strategy is passively investing every month.

Just make a plan for yourself, timing the market is something that is (almost) impossible. My advice is always to not try and time the market. Just invest regularly and you will do more than fine!

If you have any more questions, don’t hesitate to ask me!

Thanks for your comment,

Kind regards,

Michiel

Hi Michiel,

Thanks for sharing your knowledge about investing in this blog. I also live in Belgium and appreciate all the info. In particular because I live in Belgium too, I have a few questions, if you don’t mind me asking.

Do you use a pension fund due to tax benefits?

Which bank do you use as a saving account? I’m at Argenta with an interest rate of Base 0.01% Fidélité 0,10 % Taux d’intérêt 0,11 % which seems to be standard compared to other banks, or do you have a closed saving account? Sorry I’m really just starting to think about investing and saving.

Thank you! Best regards. Tanja

Hi Tanja,

Thank you so much for your comment. I am glad to hear that other fellow Belgians are interested in investing as well!

Do you use I pension fund due to tax benefits?

I am not doing that right now. I’ve checked the options with some of the big banks though. My findings were the following: There is not much freedom on how your funds are allocated. Banks charge a lot of fees (for example: 1% every time you put money in the fund, 2% yearly management fees). You also have to pay 8% on your gains when you turn 60. I made a quick calculation and I found that due to these fees and taxes you will lose almost all (if not all) the tax advantages you’ll have through the years. This together with the fact that your money is inaccessible until you retire (unless you pay a lot of taxes) made me decide to not do it and just invest myself!

That being said, I do not think it is a bad idea to put money in a pension fund. It just is not for me at this moment. I do have group insurance with my employer which will provide me with some money when I retire!

Which bank do I use as a saving account?

Currently, I am using KBC. I think it is 0.10+0.01% as well. The difference between banks is so small that I don’t even bother looking for a better yield. My philosophy is that I only want an emergency fund in the bank anyway. All my other money needs to be invested! Right now I do still have 40% in cash because I am saving up to buy a small apartment.

I hope this answered your questions? If you have any more, feel free to contact me! I always love to help other people out.

Kind regards,

Michiel

Hi Michiel,

Many thanks for your quick reply! I really appreciate it. Regarding the pension fund I have talked to some friends who also had the opinion that it wasn’t really worth it when you do the math, but it’s always good to have another opinion, especially since I just started to think about investments and have barely checked the system and regulations around it! So thanks for sharing your opinion. I might come back with more questions at a later point regarding ETFs! 🙂 But for now have a great evening!

Hi again! So I do have another question for you if you don’t mind me asking!

You mentioned that at some point you wouldn’t touch the money in your ETFs for the next 10-15years. In which time frame are you looking to invest in an apartment? Say you will buy it in around 2 years from now, wouldn’t it be better to have it in an ETF instead, and say the market goes down, so you just wait another year and buy the apartment then? Or to take a portion of your existing money in ETFs and buy an apartment?

Also if you bought an apartment would you take out a mortgage, and in the particular case of Belgium and the interest rate here, would that make sense? Sorry, I hope this questions aren’t too obvious! Thank you. Best, Tanja

Hi, do you invest in Asia ETF Stock?

Hi Tyme Lyme,

Sorry for the kind of late reply. I don’t invest in an ‘Asian ETF’. I do invest in an Emerging Markets ETF which includes a lot of Asian exposure!

Kind regards,

Michiel

Hey Michiel,

Great blog, nice to see another Belgian FIRE blogger around. Great for you that you started early and are doing so well, keep it up!

Hi Mark,

Thanks for stopping by! Just hope I can stick to my own plan!

Kind regards,

Michiel